Why Now?

The district is proposing the Referendum to address the significant needs that have been identified in the Facilities Master Planning Process in regards to security improvements, building infrastructure updates and elementary capacity.

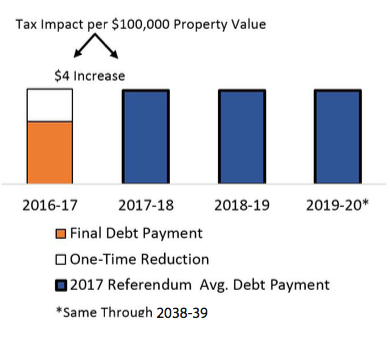

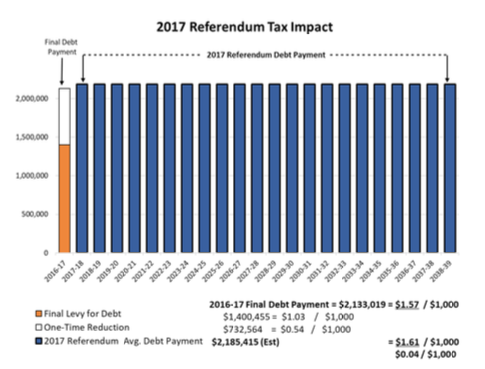

As the final payment on prior referendum debt for the construction of Reedsburg Area High School was made during 2017, tax payers will see minimal tax impact in the passing of this Referendum.

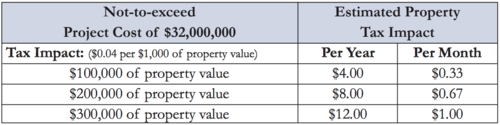

Tax Impact

The tax rate increase is projected to be $4.00 for every $100,000 of property value.

The District made its final payment on prior referendum debt (Reedsburg Area High School) of $2,133,018 during 2017. The average estimated 2017 Referendum debt payment is $2,185,000. The tax rate increase of $0.04/$1,000 ($4.00 per $100,000) of fair market property value compares the final debt payment to the average estimated 2017 Referendum debt payment.

The Referendum projects will be financed in two phases: $10 million projected at 3.5% interest and $22 million projected at 4% interest. Payments under this financing plan would start in 2018 and finish in 2038. Tax impact estimates have been provided by financial advisors from Wisconsin Public Financial Professionals.

|